Clearing Connectivity

TradeNeXus Clearing Connectivity service provides asset managers with an integrated workflow from clearing determination, sending for central clearing, status monitoring to cleared custodial SWIFT messaging.

In light of uncleared margin rules (UMR) impacting buy-side clients and increased market adoption of central clearing, TradeNeXus has developed a tailored solution to facilitate asset manager adoption of FX clearing into their workflow.

The challenge for asset managers

The voluntary nature of FX clearing has meant that there has not been a fixed transition date meaning adoption has been piecemeal with limited technology developments to support this new workflow. Different from their bank counterparts, asset manager determination to clear may vary by a number of factors such as fund, counterparty and currency. Additionally, FX clearing has meant bifurcated operational setup and management from trade enrichment, matching to custodial messaging.

Solution

TradeNeXus Clearing Connectivity allows for asset manager adoption of FX clearing into their workflow with reduced disruption to existing trade operations and options for no additional integrations. Clients can either identify incoming trades for clearing or customize rules in TradeNeXus to identify trades for TradeNeXus to submit direct to CCP for clearing.

Benefits

No change to execution

No change to OMS required to tag trades for clearing

Management of clearing trades and status monitoring within TradeNeXus

Automated and direct submission of trades to CCP

Features

User defined rules engine to determine transactions to clear and clearing broker (FCM) selection

Rules are set at allocation level allowing for mix of cleared and bilateral allocations

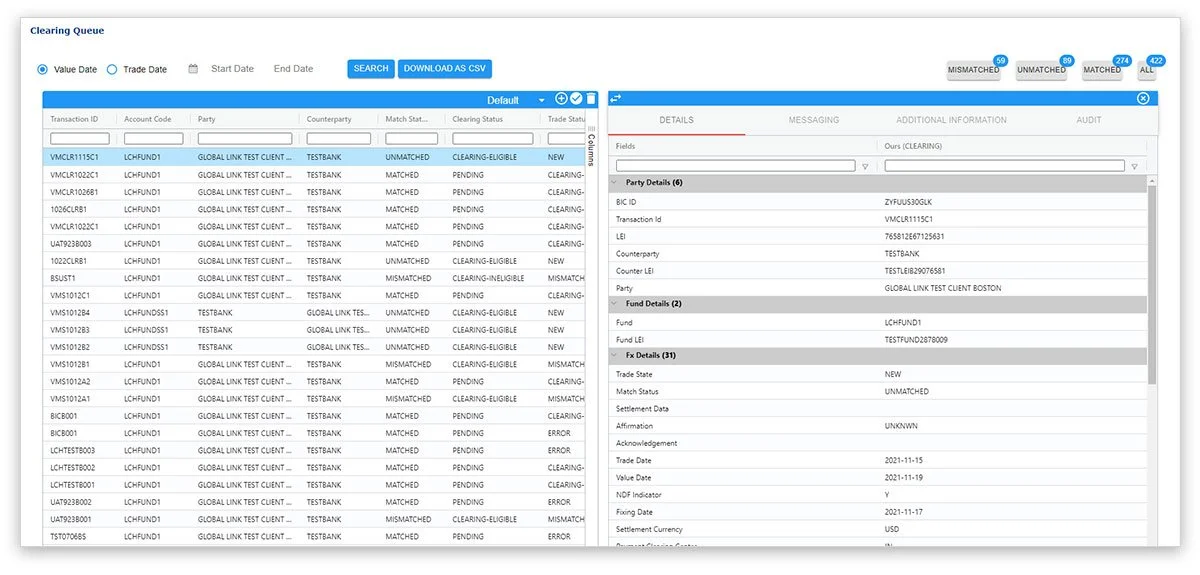

Dedicated Clearing Queue with filterable querying and full audit trail in a consolidated screen

Enriched cleared SWIFT messages to Custodians and agents

Ability to resubmit or send trades to bilateral workflow

Other Services

-

CLSTradeMonitor

TradeNeXus CLSTradeMonitor integrates CLSSettlement status information into the TradeNeXus application to provide consolidated monitoring and linking of trade information and audit trail to provide a holistic view for easier query resolution.

-

Trade Optimization

Providing asset managers with access to identify optimization opportunities, automate their compression and novation workflows, and consolidated monitoring.